It’s time. While everyone else is getting ready for their Canada Day (or July 4) long weekend, the basketball world will be at the starting line of the 2018-19 season, champing at the bit to strike first in free agency while navigating a very tight summer cap environment league-wide. Free agency begins at the stroke of midnight late Saturday/early Sunday, and with it we venture further into the New TV Money Era, where a lucrative national rights deal has pushed the NBA’s salary cap from $70 million in 2015-16 to an estimated $101 million this coming season.

This year marks a major leveling off, and the Toronto Raptors are hardly the only team that will be feeling the crunch of that cap plateau after a few summers of willful spending. To wit, last year’s salary cap was originally estimated at $103 million and came in at $99 million, and this year’s latest estimates have it falling between $101 million and $102 million. That stagnation keeps the luxury tax and luxury tax apron figures similarly depressed, which is a big deal considering most contracts rise steadily over the life of the deal – while DeMar DeRozan, for example, has a nice smoothed salary structure, both Kyle Lowry and Serge Ibaka signed deals with nearly eight-percent annual increases, meaning they’ll take up a larger chunk of the cap as the cap rises by just 2-3 percent.

With big money committed to those three, Jonas Valanciunas, and now Norman Powell (whose extension kicks in July 1), president Masai Ujiri and general manager Bobby Webster enter a second consecutive offseason where unloading a salary will be a necessary part of the plans. This also comes while they aim to keep restricted free agent Fred VanVleet on what should be a sizable deal, meaning they’ll once again be trying to fill out the back of the roster with inexpensive pieces, a tougher task this year since they didn’t have a draft pick. There are means of clearing cap space, and the Raptors at least have the proper rights and exceptions to afford them some flexibility they haven’t always had in prior years. The Raptors are also in a unique position this year of being an almost certain luxury tax team for the first time since 2004, and where last year moves were aimed at ducking the tax, this year’s moves will probably focus more on lessening the overall tax bill instead (unless they’re really going to strip things down or deal a star, which are possible outcomes).

All of this will require some careful salary gap gymnastics. Luckily, the Raptors’ front office is well-staffed to execute such machinations, with Webster being a former league cap adviser, Ujiri possessing a strong track record of landing bargain fliers (albeit overpaying established pieces), and a strong player development staff making sure the inexpensive back end is ready to contribute where the offseason agenda may leave a hole. Still, it won’t be easy, and something on the roster will surely have to give.

What follows is an explanation of the contract situations and cap rules that the Raptors face right now. This is the fifth year in a row I’ve done this post in the hopes of helping readers understand why certain moves can or can not happen, and how they may come to pass. The league has a new collective bargaining agreement as of last year, so this year should be a little easier to navigate since it’s not Year One of a new document. Some of it will be in less detail than is necessary for a thorough understanding and some of it will be in more detail than is necessary for a cursory understanding (apologies if I haven’t correctly navigated that middle-ground) – if you have any questions, tweet them to me @BlakeMurphyODC or email them to me at eblakemurphy1@gmail.com, and I’ll do a follow-up post explaining certain rules or scenarios.

Note 1: All of the exact exception amounts and a lot of the assumptions within are based on the projected percentage increase in the salary cap. We won’t know the real numbers until free agency actually begins and the league sets the official cap for 2018-19. Right now, we’re working on an assumption of $101-102 million for the cap and $123 million for the tax.

Note 2: All salary data and cap info comes courtesy of Basketball Insiders, CBAFAQ.com, or my own calculations based on the CBA document. (Yes, I read the entire thing last summer because we didn’t have CBAFAQ yet. I don’t recommend it.) Also, a thanks as always to Daniel Hackett, who I have probably clarified some of this stuff with at some point as we figured out the new climate last year and the finer details this year.

Contracts, holds, and explanations

Contracts

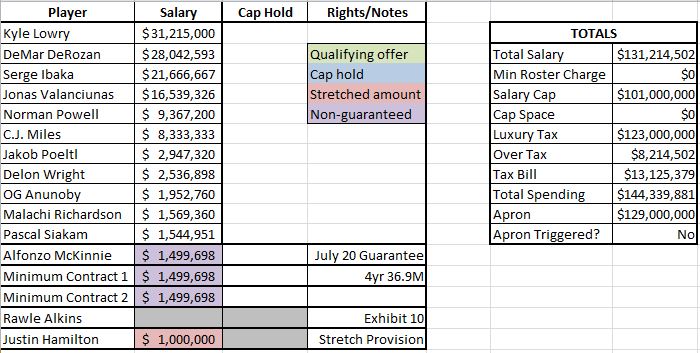

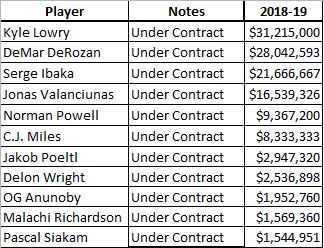

The Raptors have the following contracts on their books for 2018-19:

That is…a lot of salary already committed. It’s $125.7 million, to be exact, which is already above the $123-million projected luxury tax line. Even before filling out the roster – teams must have 14 players when the season starts, and there’s an artificial “incomplete roster charge” that goes against the cap to get a team to 12 players (to prevent teams from circumventing the cap by stripping the roster entirely) – the Raptors are into the tax, and they’re obviously missing one pretty important name from that cap sheet in Fred VanVleet.

A small note here: I increased the salary amounts for Kyle Lowry and DeMar DeRozan slightly over the amounts you’ll find elsewhere publicly. This is because Lowry – and maybe DeRozan, depending on which initial reporting of his contract you go with 0 have unlikely incentives built into their deals, which I explained in greater detail last summer. Essentially, unlikely bonuses only matter in the tax and tax apron calculations, not actual salary cap number calculations. However, because Lowry achieved one of his unlikely bonuses – making the All-Star team while playing in at least 65 games – that will now be classified as a “likely” bonus and count toward the team’s cap number. (That was worth $200,000 last year; I’ve escalated it slightly here in line with the increase in Lowry’s total incentive amount, to $215,000, but that was actually incorrect and it will remain at $200,000 for next year.) I’ve also assumed here that the small unlikely bonus for DeRozan has been achieved, given he started in the All-Star Game and made All-NBA Second Team, though it’s possible that his unlikely benchmark is something loftier (MVP, First Team, etc). I will not be assuming DeRozan’s unlikely bonuses outside of this exercise, at least until I can confirm their existence beyond loose reporting.

These are small assumptions that don’t matter a ton at this point and that we should have clarity on when the part of the offseason rolls around where we’re projecting a tax figure.

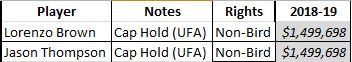

Unrestricted Free Agents

The Raptors have the following unrestricted free agents, with their cap holds and rights types highlighted:

Yes, that’s Jason Thompson still kicking around from 2015-16. It’s pretty meaningless given that it seems like his NBA career is over, and the Raptors could simply renounce his rights if they needed the cap space that the cap hold is taking up. Book-keeping wise, it remains simply because there’s no impetus to renounce those holds until you need to, and the Raptors will be operating as an above-cap team again this offseason.

Clearly, the Raptors don’t have a lot of salary coming off of the books. Lorenzo Brown is their only unrestricted free agent (for the time being), an agency afforded him because the Raptors converted his two-way contract to an NBA deal at the tail end of last season (otherwise he would have been restricted coming off of his two-way deal). Like with Thompson, there’s little reason to remove Brown from the books even if he wasn’t in the plans, though they have no recourse to retain him if he signs elsewhere looking for a guarantee.

(Until the rights to those players are renounced, the players have cap holds noted in italics, which count for the purposes of the salary cap to prevent teams from signing a bunch of free agents with cap space and then signing their own guys. In many cases, ordering signings in that way can still be beneficial, but for the Raptors, it will be largely irrelevant this year. The cap hold is removed if the Raptors renounce the rights or the player signs a new contract, in Toronto or elsewhere.)

The usefulness of lower cap holds isn’t much in play for Toronto here, and in this case the Raptors don’t hold Bird rights or even Early Bird rights on Brown. Full Bird rights allow a team to exceed the salary cap to re-sign their own player up to the maximum contract, while Early Bird rights allow a team to exceed the cap to re-sign their own player for up to 175 percent of his previous salary or 105 percent of the league-average salary the year prior, whichever is larger. More on Early Bird rights shortly. Non-Bird rights, like the Raptors have on Brown, aren’t particularly helpful – the Raptors could exceed the cap to re-sign Brown for up to 120 percent of the minimum salary, but Brown doesn’t figure to command more than the minimum if he’s retained, anyway.

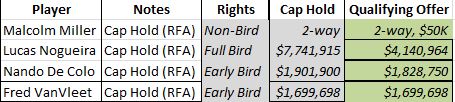

Restricted Free Agents

The Raptors have the following restricted free agents, with their cap holds highlighted:

This is the first time the Raptors have had a marquee restricted free agent in some time, with Fred VanVleet’s status being the team’s biggest offseason focus. To keep his rights in restricted free agency, the Raptors will have to tender him a $1.7-million qualifying offer. VanVleet is free to sign that one-year deal, but with a free agent of his stature, it’s mostly a book-keeping note that will give the Raptors the option to match any offer sheet VanVleet signs elsewhere. I did a deep explainer on VanVleet’s restricted free agency here, but to summarize briefly: The Raptors can use their Early Bird rights to offer him up to 105 percent of the league-average salary on a four-year deal, which would pay him up to $36.9 million over four years. He can sign for more elsewhere (four years and an estimated $74.4 million) but is subject to the Gilbert Arenas provision that would back-load the deal and give the Raptors the opportunity to swallow hard and match. This is going to be really interesting, especially with the Raptors already into the tax and any VanVleet deal carrying luxury tax payments with it (unless they can unload a salary).

The question is much tougher with Lucas Nogueira, who carries a $4.1-million qualifying offer that he’d very likely sign. With the Raptors in a tough tax spot and employing two other centers (three if you want to include Serge Ibaka), it seems likely that they’ll non-tender Nogueira, making him an unrestricted free agent. If they do, they’ll still hold Nogueira’s Bird rights and will be able to exceed the cap to re-sign him, they just won’t have the right to match any offer he signs elsewhere. It would be great to have Nogueira back on the cheap, but risking a $4.1-million salary for a third center, plus the tax penalties that would come with adding such a deal, is a luxury the team can’t afford, especially with how inexpensive the back end of the center market usually is in free agency.

Malcolm Miller’s qualifying offer is simply a two-way contract with $50,000 guaranteed, and it’s somewhat of a no-brainer to tender it to him since he won’t sign it and it will give the Raptors the option to match any offer sheet he signs elsewhere. With Miller probably only looking for a guaranteed minimum deal, it’s possible Miller winds up back in Toronto as versatile wing depth.

And yes, that Nando De Colo. The Raptors still own his rights in restricted free agency (and his Early Bird rights), even though he’s playing on a multi-year deal with CSKA Moscow (it reportedly has one year left with no NBA out). If the Raptors want to retain his RFA rights, they’ll need to issue him a $1.83-million qualifying offer by June 30, one that will stay on the books all summer (note that I used his cap hold amount rather than his $1.83-million qualifying offer) unless the Raptors rescind his rights. This is mostly just a bookkeeping note – De Colo isn’t coming over, but if their offseason maneuvering allows, the Raptors may be able to maintain his rights and keep him on the books through the summer. In an offseason in which they don’t figure to have cap space, anyway, there’s little cost to issuing him a qualifying offer to retain his rights.

I wrote in greater detail about these qualifying offer decisions a few weeks back.

Non-guaranteed Deals

The Raptors have the following non-guaranteed deals:

Alfonzo McKinnie’s minimum contract becomes fully guaranteed for the year on July 20 and is fully non-guaranteed before then. Essentially, this works as a team option they have to decide on by the time Summer League rounds out, and McKinnie will be looking to show he’s worthy of sacrificing that modicum of flexibility in Las Vegas. He’s a nice piece, with versatile defense and a ton of open-court speed, so with the Raptors looking to fill out the bench on the cheap, he makes a fair amount of sense. The team could, however, decide that keeping that roster spot open for other targets is more valuable than keeping McKinnie in the fold.

One note to make in the new CBA is that players on non-guaranteed contracts now count for only their guaranteed amount in the outbound salary part of trades, not the full non-guaranteed amount. This doesn’t matter much for low-salaried players like McKinnie who wouldn’t bring much salary back, anyway, but it could come up if, the Raptors wind up signing someone with a significant non-guaranteed year at the tail end of the contract.

Rawle Alkins has been signed to an Exhibit 10 deal (a one-year, non-guaranteed minimum deal with an option to convert to a two-way contract and up to $50,000 in bonus if he is cut and spends enough time with Raptors 905), but Exhibit 10 bonuses do not count for the purposes of the team salary calculation. Two-way contracts, if and when the Raptors give them out, also don’t count in the team salary calculation.

Justin Hamilton

The Raptors acquired Justin Hamilton in last summer’s DeMarre Carroll trade and used the stretch provision to spread his $3-million cap hit out over three seasons. He will therefore count as $1 million against the cap and tax this year as dead money.

Off the Books

K.J. McDaniels and Nigel Hayes were both on the books at one point last year, McDaniels for a $100,000 guarantee and Hayes for a pair of 10-day contracts. Both players are off the books, as they were waived during the season. The Raptors hold no rights to either player.

Draft picks

The Raptors did not have a first-round draft pick, so there is no cap hold on their books for a first-round pick. If they had, the cap hold for first-round draft picks would be equal to 120 percent of the rookie scale amount for that draft slot. (This is because in almost all cases, first-round picks sign for 120 percent of scale.) Any future picks are unlikely to be any different, but if they signed for less, his cap number would decrease accordingly. Once a first-round pick signs his deal, he can’t be traded for 30 days.

Second-round picks don’t come with a cap hold and aren’t beholden to the rookie scale, but the Raptors don’t have one of those to worry about here, either.

Two-way contracts

With Lorenzo Brown having been converted to an NBA deal and Malcolm Miller set for restricted free agency, the Raptors will have both of their two-way roster spots open (technically, they’ll have to renounce their rights to Miller or wait until he signs an NBA deal somewhere to use the second slot). On one of these deals, a player will receive a higher GLeague salary for their time spent in the GLeague and a prorated amount of the NBA minimum while in the NBA. Time in the NBA is capped at 45 days during the regular season, plus any time before the start of GLeague training camp and after the conclusion of the G League regular season. These players are not eligible for the NBA playoff roster, though the team will hold the option to convert the two-way contract to a regular NBA contract at the minimum (for that player’s service time) at any point. Last year, both Brown and Miller saw ample NBA time and earned something close to their two-way maximum salaries (an estimated $370,000 for last season).

The big picture

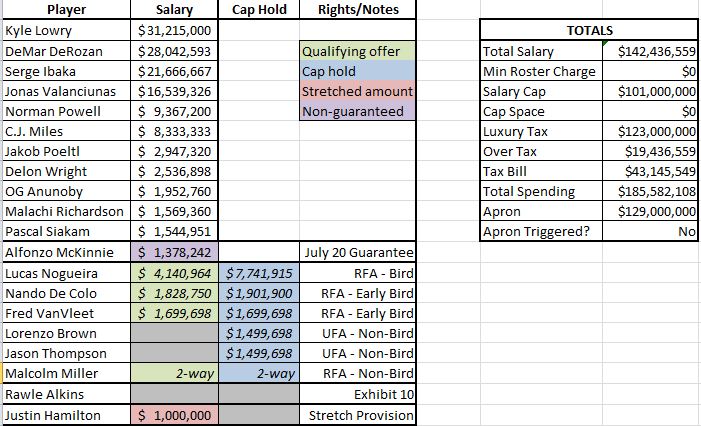

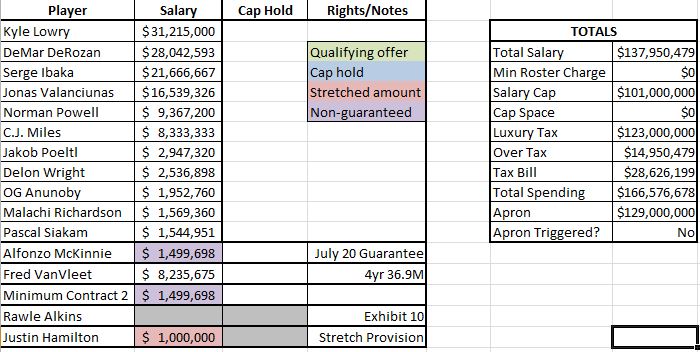

Here’s how the Raptors’ cap sheet looks at present:

As constructed, this is not particularly useful. It shows the Raptors’ total salary and expenditures with all of the players still on the roster, as well as all five NBA cap holds. Not only is that 17 players, it’s a completely useless approach to take for planning purposes, as we can make some broad assumptions to narrow our focus here. The reason I start there, though, is twofold: First, because it lays out the entire “official” cap sheet, which I feel is an important step. Second, because it illustrates just how quickly the luxury tax can ratchet up the team’s total salary expenditure.

A note on the luxury tax

I couldn’t decide if the luxury tax calculation was worth including in this post or not. The tax is charged on an escalating marginal basis, such that the first $4,999,999 is taxed at $1.50 per dollar, and the tax increases for each subsequent $5-million block. (In this example, the Raptors would be paying $3.25 in luxury tax per-dollar on the last $4.4 million in salary, as this snapshot has them into the fourth of five tax tiers.) It’s basically an escalating penalty the further over the tax you go, to where trimming, say, $9.6 million could wind up saving the team significantly more depending on which tax block they sit in at the time. We’ll go into some of these scenarios in the coming weeks as we update the cap sheet. A note: The luxury tax owed is calculated based on the roster for Game 82, so the Raptors could conceivably enter the season well into the tax and get under it later in the year. As for the “repeater tax” that introduces harsher penalties as teams stay in the tax too long, the Raptors don’t have to be incredibly concerned – they ducked the tax in 2017-18, and even though they project to be a tax team again in 2019-20, their 2020-21 and 2021-22 cap sheets are pretty clean, to where it seems unlikely they’ll be in the tax three of the next four years plus an additional year after that for the penalties to take hold in.

Back to the big picture

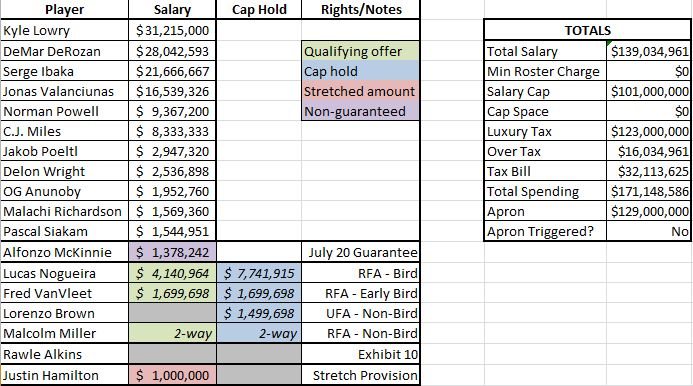

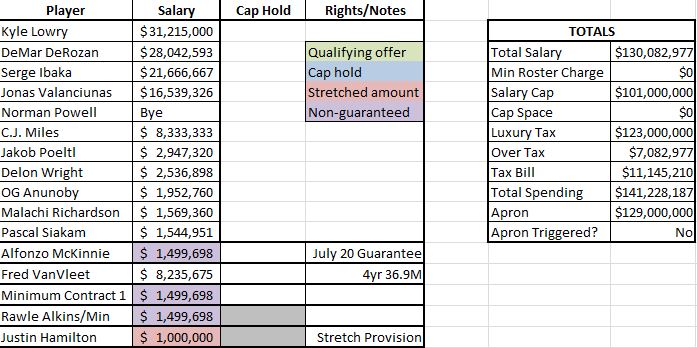

Again, the cap sheet above isn’t all that helpful for offseason planning, because, well, there’s no way they’re going to rival the largest payroll of all time. We can pretty safely remove Nando De Colo and Jason Thompson from our accounting here for simplicity, as De Colo will eventually let his qualifying offer expire and Thompson is irrelevant to the team’s situation – there is no chance the Raptors aren’t operating as a cap team (they would have to shed over $27 million and renounce all their holds just to get below the cap, and another chunk further for that to be useful space). Here’s what the cap sheet looks like in a more relevant sense:

They’re still way over the cap. From here, we’re going to focus on the luxury tax number, since we’ve shown the actual cap number won’t matter much to the Raptors. They are operating as an above-cap team this summer.

For illustrative purposes, this is what the cap sheet would look like if they renounced the rights to all of their free agents including Fred VanVleet, and let Alfonzo McKinnie’s deal guarantee. They could cut McKinnie in this scenario, but even a rookie minimum is charged to the tax at the rate of a second-year veteran minimum, so there would be no gain for tax purposes, as you see with the additional two minimum contracts to bring the roster to 14. (Also note that I bumped McKinnie’s number to the two-year minimum since we’re now focusing on the tax number rather than the cap number; that’s a small change designed by the league to prevent teams from favoring rookie minimum players over veteran minimum players, so every minimum counts the same for tax purposes and the league foots the difference for veterans.)

This is a pretty reasonable outcome, were the Raptors willing to let VanVleet walk. They spend nearly $8 million on tax, have a clear 10-man rotation with Norman Powell sliding in for VanVleet, have four inexpensive players fill out the third string (perhaps those two are Malcolm Miller and Lorenzo Brown for continuity’s sake, or Rawle Alkins makes the team), and then maybe leverage their two-way slots again to create a de facto 15th man between them like they did last year. It wouldn’t be the worst outcome, though it sure would be anti-climactic, and the Raptors would probably still be working to unload a salary throughout the offseason to get that remaining $5.2 million under the tax.

At the same time, it seems quite unlikely they’re willing to let VanVleet walk. If we assume VanVleet commands the full four years and $36.9 million the Raptors can offer him out of the gate, suddenly the tax situation looks quite dire again:

Adding $8.24 million for VanVleet’s first year salary has resulted in a $22-million jump in total spending because all of that money is coming in the second and third tier of the luxury tax penalty, given the Raptors’ other commitments. This is why it seems likely the Raptors will try to unload someone in order to make retaining VanVleet more palatable. As one more example – we could go into every different scenario with Serge Ibaka, Jonas Valanciunas, or whomever being traded instead – here’s what it would look like if the Raptors can find a home for Powell and then re-sign VanVleet.

Unloading Powell saved $25 million in this example.

The luxury tax apron

You’ll notice that in all of these graphics there is an “apron” cell, which refers to the NBA’s luxury tax apron. The luxury tax apron sits $6 million above the luxury tax line and acts as a hard cap in certain scenarios. Teams can exceed it, but doing so takes some options off of the table. You can not, for example, acquire a player in a sign-and-trade or use the full mid-level exception. Doing either of those things “triggers” the hard cap, as the Raptors did last summer, meaning under no circumstances during the year could they ever exceed that apron amount.

Complicating matters is that for the purposes of calculating the luxury tax apron, all unlikely bonuses count (the league has to assume every penny will be realized, otherwise teams could not-so-accidentally end up above the apron after bonuses are realized). For Toronto’s accounting, this means Lowry’s unlikely bonuses count, pushing his salary amount to $33,333,334 instead of the $31,215,000 we’ve assumed throughout this exercise. The Raptors don’t have to count those bonuses toward their internal luxury tax projections, but it matters if they wind up in a scenario where they trigger the hard cap or for a few other reasons.

Passing the $129-million marker in salary does the following:

- You can’t acquire a player in a sign-and-trade

- You can’t use the Bi-Annual Exception

- You can only use the smaller, Taxpayer Mid-Level Exception

- You lose some of the protection of the Gilbert Arenas Provision

The first three notes aren’t huge deals, as the Raptors probably aren’t in the market to acquire major salary, anyway. Losing the ability to acquire via sign-and-trade limits flexibility, sure, but the smaller mid-level isn’t all that big a deal if they’re that far into the tax since they won’t want to spend that much and the bi-annual exception will probably be pocketed in favor of minimum-salaried players filling out the roster. The fourth note sounds big given VanVleet’s status as an Arenas Provision controlled player, but luckily the Raptors hold his Early Bird rights and could use those, rather than their full mid-level exception, to match an offer sheet.

The Raptors would probably like to stay below the estimated $129-million apron for flexibility’s sake, and they may use that as a soft internal cap of sorts as they navigate the offseason. I would like to dive into this more, but this article is already exceptionally long and it’s probably worth saving some of the apron implications for scenario analysis once the offseason begins playing out.

Exceptions

There are sometimes scenarios in which it makes sense for a team to stay above the cap, not that the Raptors have a choice here. By doing so, teams open themselves up to the non-taxpayer or taxpayer mid-level exception and potentially the bi-annual exception if they’re below the tax apron. Here’s a quick look at the salary cap exceptions available to the Raptors.

Note: All of the exact exception amounts are based on the projected percentage increase in the salary cap. We won’t know the real numbers until the weekend.

Get under cap

If the Raptors go under the cap by renouncing multiple free agents and trading away a ton of salary, they’ll have the following:

Cap space: Depends on how many free agents they lose/renounce, but this is woefully unrealistic

Room mid-level exception: $4,436,200 (one- or two-year deals with a 5-percent raise; can be split between players)

Stay above cap, below tax apron

If the Raptors stay over the cap as outlined but below the tax apron (after using the exception in question), they’ll have the following:

Cap space: $0

Non-taxpayer mid-level exception: $8,616,150 (up to a four-year deal, with raises of 5 percent of the first-year salary; can be split between players)

Bi-annual exception: $3,372,250 (one- or two-year deals with a 5-percent raise; can’t be used two years in a row; can be split between players)

As a side-note, if a team uses the Bi-Annual Exception, the apron becomes a hard cap the team can’t cross for the rest of the season. You can only use the Bi-Annual Exception once every two years. If they use more than $5,192,000 of the non-taxpayer mid-level exception, the apron becomes a hard cap.

Stay above cap, reach tax apron (this is likely how the Raptors will operate)

If the Raptors stay over the cap as outlined and an exception would push them above the tax apron, they’ll have the following:

Cap space: $0

Taxpayer mid-level exception: $5,321,800 (up to a three-year deal, with raises of 5 percent of the first-year salary; can be split between players)

The Raptors would also have the minimum player salary exception, which allows you to exceed the cap to sign players on veteran minimum deals, in any of these cases.

Trade Exceptions

The Raptors have the following trade exceptions:

- DeMarre Carroll, expires July 13, $11,800,000

- Cory Joseph, expires July 14, $6,125,440

- Bruno Caboclo, expires Feb. 8, $2,451,225

Trade exceptions allow a team to take back salary without sending any out in return, for up to the amount of the exception plus $100,000. They can not be combined together or combined with players to add extra salary; they’re stand-alone tools. The Raptors aren’t in a position to take on much salary, but these could still be helpful for structuring trades so they’re effectively multi-part deals.

Trade Rules

One small note with the Raptors figuring to be a tax team, or at least operate as one early in the offseason, is that teams above the luxury tax operate under different trade rules. Luckily for us, they’re simplified: A tax team can only take on up to 125 percent of their outgoing salary in a trade, plus $100,000. This is less flexibility than non-tax teams have.

Assets

Picks

The Raptors own all of their own future first-round picks and all of their own second-round picks from 2019 onward. Teams can trade picks up to seven years in advance but can’t trade first-round picks in consecutive future seasons (this strictly applies to picks in the future tense, so even though the Raptors traded their 2018 pick, that’s in the past now, and so they’re eligible to trade their 2019 pick).

Draft Rights

The Raptors own the draft rights to DeeAndre Hulett from back in 2000 and Emir Preldzic from 2009, whose rights they acquired in the Cory Joseph trade last summer. Hulett was never anything more than a footnote, and while Preldzic is a wholly capable international player for Galatasaray in Turkey, he’s not at all NBA relevant.

These rights mean little, they also cost little, and in the event the Raptors wanted to acquire someone for nothing (think Luke Ridnour for Tomislav Zubcic in 2015, or the Joseph-Preldzic deal that facilitated the C.J. Miles signing), these rights can be used as “consideration” (both teams need to send something to the other in a deal).

Cash

The league allows teams to send out and receive up to a certain amount of cash in aggregate each cap year. This amount spiked from $3.5 million to $5.1 million for last year, but the jump projects as much more modest this time around. Based on current estimates, the Raptors will have about $5.23 million to include in trades for the cap year beginning July 1.

Wrap

That’s a lot to sort through. The front office doesn’t have an easy job, and putting this together is a stressful endeavor because I know there are a handful of fans out there who will want even more detail/explanation and some who thought this was too in-depth for what a general fan needs. This is meant to be a pretty high-level preview of what the Raptors are working with entering the offseason (that is: not a complete scenario analysis), and I’ll do my best to keep updating with new posts as the team’s salary cap situation changes over the next few weeks.

The key points you need to know:

- There is not a ton of projected cap space on the market this summer, to where it could be fairly unfriendly outside of top names and reasonable MLE targets. That could mean more short deals as players look to re-enter a friendlier market down the line (some clarity on the NBA’s timeline for potential gambling revenue might help).

- The Raptors won’t have salary cap space and will likely be operating as a tax team, limiting their options for adding pieces outside of savvy trades. It’s not ideal, but it’s workable. It means the Raptors are far more likely to be active retaining their own free agents and empowering minimum-contract players to step into roles than landing a big, or even medium, fish.

- The Raptors can get creative by trading players away, so a lot of additional scenarios are on the table in theory. They require trading major salaries, though, and that’s either unlikely (Ibaka), hard to find a workable basketball trade for (Valanciunas), or potentially franchise-altering (Lowry and DeRozan). Any really creative offseason scenarios hinge on one of the big four salaries on the team moving out, either in a cost-cutting move or, more likely, in an actual basketball trade.

- This could all be even messier next summer. Coolcoolcool.

If you have any questions, tweet them to me @BlakeMurphyODC or email them to me at eblakemurphy1@gmail.com, and I’ll do a follow-up post explaining certain rules or scenarios.